6 mins

Fashion and beauty, e-commerce, finance and fintech apps, automotive, healthcare, and travel are the most valuable influencer niches in the UAE and GCC right now. TikTok and Instagram are the best ways to reach a lot of people quickly and get measurable ROI for both big and small creators in these areas.

These niches are a perfect match for current brand spending, proven campaign results in the area, and the audience behavior that Boomerang activates every day through a large, vetted creator network in the UAE, KSA, Kuwait, Qatar, Bahrain, and Oman.

Why Do Niches Matter In Influencer Marketing?

Not just reach, but also revenue depends on choosing the right niche. In the Gulf, resonance, platform fit, and purchase intent are very different for each vertical.

High-discretionary-spend categories like luxury fashion, beauty, and cars often do better at converting than mass-market growth verticals like groceries and fintech, which grow by volume and promo mechanics across multiple creator tiers.

When brands pair niche-fit creators with performance structures, they get big returns. This is backed up by repeatable case outcomes in the UAE and KSA.

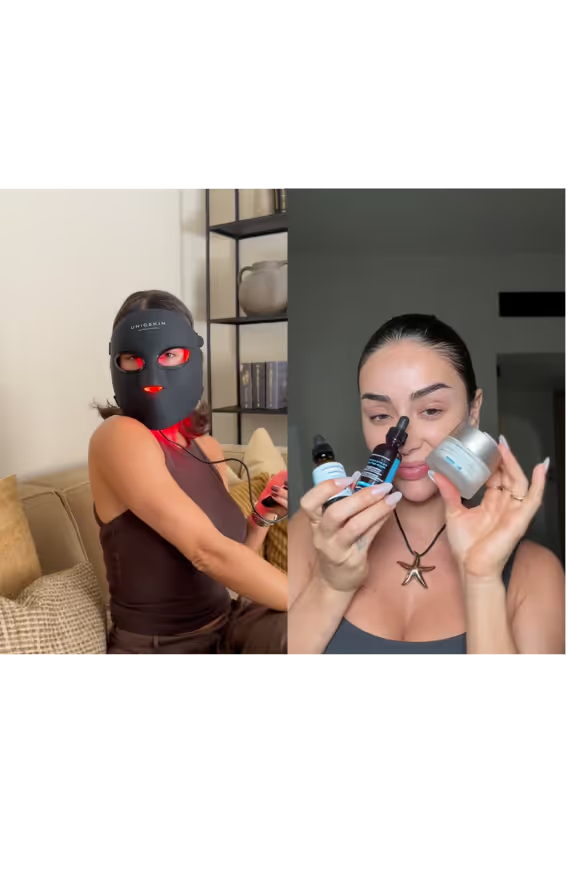

Fashion and beauty

What wins

high-end clothing brands, high-end shoes, cosmetics, perfumes, modest fashion, and Saudi/UAE style creators who use discount codes and new drop stories to get people to buy.

Proof in action

Campaigns for luxury e-commerce run by influencers that make money through sales, with steady ROI growth and monthly activations with mega and macro talent in Dubai and the rest of the GCC.

Tactics

Include always-on seeding to a mix of macro and micro, high-frequency Instagram Reels and TikTok, affiliate codes, and drops planned around UAE retail calendars and KSA peak times to shorten payback periods.

niche playbooks

o Formats: try-on reels, GRWMs, store hauls, desert and mall shoots, and UGC reviews with clean product framing.

o Metrics: code redemptions, AOV lift, assisted revenue, and content saves for evergreen value.

Example

E-commerce marketplaces

What wins

Fashion-led marketplaces, category expansion plays, and sitewide sales that got bigger every week with bigger creators across the GCC.

Proof in practice

Significant website traffic lift and sales impact from weekly campaigns blending mega reach with micro trust, showing the compounding effect of consistent marketplace storytelling.

Tactics

Weekly content schedules, whitelisting creators, stacking promotions, and hooks that are unique to each platform on TikTok and Instagram, with micro-creators used to target people in KSA, UAE, and Kuwait.

niche playbooks

o Formats: speed-run hauls, “X under AED Y,” creator cart reveals, and wishlist series tied to weekly promos.

o Metrics: sessions, CTR from stories/TikTok links, add-to-cart rate, and net-new customer share by market.

Example

Finance and fintech apps

What wins

People are using BNPL more, shopping deals with partner retailers, and lifestyle creators are turning financial benefits into savings on fashion and beauty.

Proof in practice

Combining discount-driven stories with retailer-specific calls to action and app incentives has quickly and widely reached a lot of people.

Tactics

How to get the most out of their apps, how to connect them to stores, how to use code-based rewards, how to review user-generated content, and how to market again during busy shopping times like Ramadan and the Dubai Shopping Festival.

niche playbooks

o Formats: “how I paid less” stories, retailer partner highlights, “3 ways to split payments” with creator lifestyle visuals.

o Metrics: installs, verified registrations, funded users, and merchant-linked transactions.

Example

Automotive and mobility

What wins

EV launches, lifestyle positioning, and event-driven creator experiences that turn car content into social moments that people can share all over the GCC.

Proof in practice

measurable spikes in engagement and social traffic after macro and micro creators go to launches and spread the word about regional announcements.

Tactics

press-day vlogs, TikTok test-drives, creator IRL events, and family/luxury niche segmentation that show the different types of buyers in the Gulf, from KSA to UAE.

niche playbooks

o Formats: launch day vlogs, test-drive TikToks, family-space checks, and EV charging myth-busters.

o Metrics: lead form completions, test-drive bookings, and event RSVPs from creator links

Example

Healthcare and clinics

What wins

patient-education content, service highlights, and doctor-led authority paired with lifestyle creators for reach extension across the UAE.

Proof in practice

A lot of people know about small groups of influencers, which shows that fewer, more trustworthy voices can grow when trust is important.

Tactics

Regulated messaging frameworks, Arabic/English localization, hooks for clinic offers, and Instagram-first content that combines authority with stories of patients that are easy to relate to.

niche playbooks

o Formats: doctor Q&A, clinic tour reels, offer explainers, and pre/post care education with compliant claims.

o Metrics: appointment inquiries, consultation bookings, and FAQ deflection via content saves.

Example

Saudi German Hospital case study

Travel and hospitality

What wins

Travel and lifestyle creators offer GCC staycations, luxury hotels, discovering new places to visit, and weekend plans.

Proof in practice

Travel fits with the vertical strengths of each region, and the methods are tailored to platform-native discovery and seasonality in the UAE and KSA.

Tactics

creator-led itineraries, TikTok listicles, Instagram carousels, and timed pushes around public holidays and events to get the most people to book.

niche playbooks

o Formats: 24/48-hour itineraries, “staycation stacks,” and curated family or luxury plans that match UAE/KSA weekend patterns.

o Metrics: clicks to booking engines, code usage, and occupancy lift during activation windows.

Tech, apps, and gaming

What wins

app adoption, feature explainers, creator utility demos, and gaming tie-ins that reward participation and user-generated content (UGC).

Proof in practice

When performance mechanics are included in creative briefs and reports, mobile and tech products show measurable growth.

Tactics

Demos that are only available on TikTok, tutorials from creators' points of view, referral codes, and repeated testing in small groups in KSA and UAE to find pockets of growth.

Food and beverage

What wins

new openings, delivery deals, and chef/foodie creators who mix review content with real-life dining experiences.

Proof in practice

F&B benefits from fast feedback loops on promos and offers, enabling quick optimization.

Tactics

short tastings, day-in-the-life dining, menu reveals, and time-limited deals to get people to come in or place an order.

niche playbooks

Platform mix for Niches: Instagram vs. TikTok vs. Snapchat

· Instagram: strongest for luxury, beauty, and conversion via stories, carousels, and codes—ideal for fashion and premium e-commerce in the UAE and KSA.

· TikTok: discovery engine for marketplace growth, fintech education, and automotive experiences—short, repeatable hooks drive frequency and recall.

· Snapchat: selective value in KSA youth and Saudi/UAE daily moments; deploy for mass reach when localized content and frequency are needed.

Influencer tiers for influencer marketing niches: mega, macro, micro

· Mega and macro: drive top-of-funnel reach and social proof for launches and promos where status and trend-making matter, like luxury, auto, and marquee sales.

· Micro: deliver trust and localized conversions, crucial in e-commerce, clinics, and fintech, where explanation and community fit drive action.

· Best practice: blend tiers to balance CPM efficiency, credibility, and availability, avoiding overreliance on a few names that may be unavailable or misaligned.

Related article:

Micro vs. Macro-Influencers: Which Is Right for Your UAE Brand?

What “Good” Looks Like In The Gulf For Different Niches

· Local-first narratives: Arabic/English storytelling with GCC cultural cues, prayer times, and local retail calendars baked into scripts and captions.

· Data-driven iteration: weekly or monthly cadences that monitor attribution, creator ROAS, and audience sentiment to reallocate budget to winners.

· Transparency: brief-to-report clarity so stakeholders see creator selection logic, availability guarantees, and measurable outcomes per spend.

The mirror shows proof points for the boomerang.

· Always-on fashion and luxury: monthly campaigns since 2021 with consistent ROI demonstrate staying power in a high-competition niche.

· Marketplace momentum: sustained traffic growth and significant sales moves illustrate what weekly discipline and scaled rosters can achieve regionally.

· Reach at scale: single-campaign spikes to multi-million impressions validate amplification when timing and creators align.

Choosing A Creator For Your Niche And Making Them Available

The main benefit is that you can find the right creators for your brand in a large database of influencers, making sure they are both a good fit and available so that campaigns don't fall apart at the last minute. markets,

This is important in Gulf markets, where mega creators are often overbooked. When paired with precise briefs and local hooks, niche-fit macro/micro talent can do better at conversion.

Measurement and ROI

Set tier-specific goals for performance architecture, where mega = awareness, macro = reach plus clicks, and micro = conversions. Then, keep an eye on the blended ROAS across the board.

· Reporting rhythm: weekly snapshots during active bursts and full post-mortems by the creator that show cost, reach, engagement, assisted revenue, and content reuse value.

Scaling rules: double down on creators with better CTR or code efficiency, and stop low-intent formats and send them to high-yield niches in the same budget cycle.

Roadmap: next 90 days of content

· Month 1: Publish pillar guides on UAE/GCC influencer strategy by niche, such as fashion, e-commerce, fintech, auto, and healthcare, based on real campaign results and benchmarks.

· Month 2: Put out case studies with anonymized numbers and screenshots, as well as downloadable briefs for each niche to get leads.

· Month 3: start a "GCC Creator Index" with 50 high-fit creators by vertical and tier, along with sample hooks, content themes, and availability logic.

Why Brands Choose Boomerang

Boomerang is an expert at one thing: regional influencer marketing. This means that every campaign is designed to have a measurable effect instead of just reaching a lot of people on social media. With Years of experience in the Gulf, big clients in luxury, marketplaces, healthcare, auto, and finance, and a per-campaign engagement model, we give brands freedom, openness, and results that speak for themselves.

The difference is that we put strategy first, make it clear how to get things done, and have a feedback loop that adjusts creators, formats, and spending to what works best in the UAE and the rest of the GCC.

If you want to prioritize spending, start with fashion/beauty and e-commerce for short-term revenue. Then add fintech or automotive for scale and awareness, and finally, healthcare or travel for authority and discovery.

Each of these can be activated with the right mix of platforms and creator tiers to get people to take action in the Gulf.